Standard Tariff Charge

Operation

| S.No. | Particulars | Tariff and Charge |

|---|---|---|

| 1 | Balance Certificate Charge (for same period more than one time) | Rs. 250 |

| 2 | Statement Issue Charge (for same period more than one time) | Rs. 100.00 |

| 3 | Cheque lost and reissue of new cheque book | Rs. 100.00 |

| 4 | Duplicate FD Certificate | Rs. 250.00 |

| 5 | Charge for unused cheque (closing of account) | Rs. 10 per cheque |

| 6 | Cheque return inward (Insufficient fund) | Rs. 250.00 per cheque to drawer |

| 7 | Stop payment cheque | Free |

| 8 | Account Closing Charge | Free |

| 9 | Inter-branch cheque print | Rs. 20 per leaf |

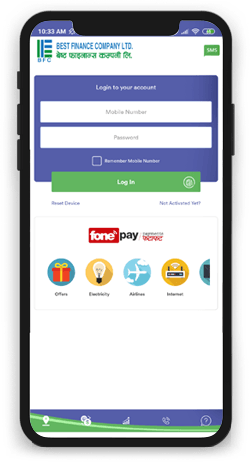

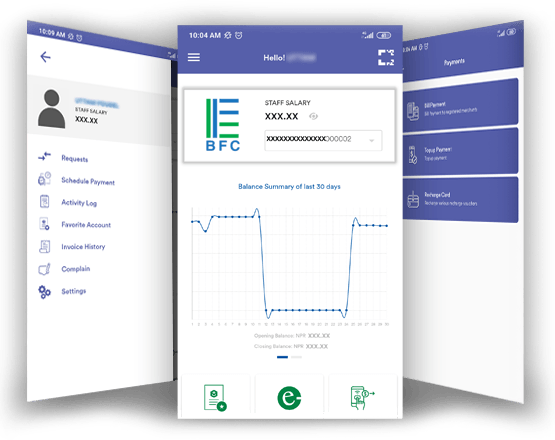

| 10 | SMS/Mobile Banking Services (Annual) (1st Year Free) | Rs. 200.00 |

| 11 | Password Reset (Mobile Banking) | Free |

| 12 | Internet banking services (Annual) | Rs. 200.00 |

| 13 | NRB cheque issuance | Rs. 200.00 |

| 14 | ABBS charge | Free |

| 15 | Issue of ‘Good for Payment Cheque’ | Free |

| 16 | Cancellation of ‘Good for Payment Cheque’ | Rs. 500.00 per cheque |

| 17 | QR Standee not received within 6 month | Rs. 250.00 |

| 18 | Destruction of uncollected cheque for more than 6 months | Min. Rs. 100.00 per cheque book or Rs. 10 per leaf whichever is higher. |

ATM Fees

| S.No. | Particulars | Tariff and Charge |

|---|---|---|

| 1 | Issuance of Debit Card (1st Year Free) | Rs. 250.00 per year (Validity for 4 Years) |

| 2 | Lost/ Damage replacement charge of Debit Card | Rs. 250.00 |

| 3 | Debit Card renewal charge | Rs. 250.00 per year |

| 4 | Card Re-pin | Rs. 100.00 |

| 5 | Debit card not received within 6 month (Disposal Charge) | Rs. 250.00 |

| 6 | Debit Card Surrendered within 1st Year | Rs. 250.00 |

| 7 | Withdrawal and balance Enquiry from own ATM Machine | Free |

| 8 | Withdrawal from other BFI’S ATM Machine | Rs. 15 per transaction |

| 9 | Balance Enquiry from other BFI’S ATM Machine | Rs. 15 per transaction |

| 10 | ATM Card Withdrawal Fee (In India) | Rs. 325 per transaction |

| 11 | Balance Enquiry (In India) | Rs. 50 per transaction |

Electronic Cheque Clearing (ECC) Fees

| S.No. | Particulars | Tariff and Charge |

|---|---|---|

| 1 | Cheque upto Rs. 2,00,000.00 | Free |

| Cheque above Rs. 2,00,000.00 | ||

| 2 | Regular Clearing (NPR) | Rs. 15 |

| 3 | Express Clearing | Rs. 100.00 |

| 4 | High Value Clearing (above 20 crores) | Rs. 100.00 |

| 5 | Late Presentment | Rs. 200.00 (30 minutes before cut off time) per cheque |

Inter Bank Payment System (IPS) Fees

| S.No. | Particulars | Tariff and Charge |

|---|---|---|

| 1 | Upto Rs. 500.00 | Rs. 2 |

| 2 | Above Rs. 500.00 to Rs. 50,000.00 | Rs. 5 |

| 3 | Above Rs. 50,000.00 | Rs. 10 |

connectIPS Fees

| S.No. | Particulars | Tariff and Charge |

|---|---|---|

| 1 | Upto Rs. 500.00 | Rs. 2 (Creditor/Merchant Payment) |

| 2 | Above Rs. 500.00 to Rs. 5,000.00 | Rs. 4 |

| 4 | Above Rs. 5,000.00 | Rs. 8 |

RTGS Fees

| S.No. | Particulars | Tariff and Charge |

|---|---|---|

| 1 | Morning Exchange | Rs. 10.00 |

| 2 | Afternoon Exchange | Rs. 20.00 |

| 3 | Evening Exchange (Only for interbank Payments) | Rs. 100.00 |

Locker Facility

| S.No. | Particulars | Tariff and Charge |

|---|---|---|

| 1 | Locker size (1/A) (Size: Height 6 Inch, Width 8 Inch and Depth 18 Inch) |

Security Deposit: Rs. 5,000.00 (Held on respective saving account) |

| 2 | Annual locker rental charge | NPR Rs. 2,000.00 |

| 3 | Release charge of locker | Rs. 500.00 before the expiry of lease period |

| 4 | Locker break charge | As per actual cost |

Loans and advances

| S.No. | Particulars | Tariff and Charge |

|---|---|---|

| Loan Administrative Fee | ||

| 1 | Loan Administrative Fee (Service Charge) on New Loans | |

| 1.1 | Agriculture & Margin Loan | Upto 1.0% |

| 1.2 | Wholesale Lending Deprived | Up to 0.05% |

| 1.3 | Consortium Loans | As per Consortium Agreement |

| 1.4 | Loans above 2.5 crore on single business exposure | Upto 1.00% |

| 1.5 | Other Loans (except stipulated above) | 1.25% |

| 2 | Renewal Fee | |

| 2.1 | Wholesale Lending Deprived | Up to 0.025% |

| 2.2 | Other Loans (except stipulated above) | 0.25% |

| 3 | Commitment Fee | |

| 3.1 | Commitment Fee (Overdraft Nature Loans) | 0.10% of unutilized limit (Charges applicable when annual utilization is below 60% of limit.) |

| 3.2 | Commitment Fee – Long Term Finance | 0.10% of unutilized limit |

| 4 | Prepayment fee above NPR 5 Million | Prepayment within 2 years:- 1.25% |

| Prepayment within 2 years to 5 years:- 0.625% | ||

| Prepayment after 5 years:- 0.25% | ||

| 5 | Loan swap (Outward) – up to 2 years from the date of loan provided | 1.25% |

| 2 years – 5 years from the date of loan provided | 0.625% | |

| More than 5 years from the date of loan provided | 0.25% | |

| Not receiving business activity report | Nil | |

| Insurance not renewed on time | Nil | |

| Request for facility renewal not received on time | Nil | |

| 6 | Certification/letter for credit client | Rs. 500/- per certification |

| 7 | Valuation charge | As per Valuation Guideline of the bank |

| 8 | Partial release of Fixed Assets Collateral/Vehicle. Collateral Exchange, Re-mortgage | Rs. 2,000/- Flat |

| 9 | Share Release/Replacement Charge | Rs. 500/- Flat |

| 10 | Payment of insurance on the request of customer | Nil |

| 11 | Assisting the borrower to obtain copy of blue book | Rs. 1000 |

| 12 | Certify/endorse the claim lodged application by the borrower to the insurance company | Free |

| 13 | Credit Information Charges (including blacklisting/ delisting etc.) | Actual cost |

| 14 | Penal Interest charge on expired OD | Additional 2% above applicable interest rate |

| 15 | Penal Interest Charge on Term Loan Overdue Installment | Additional 2% for the amount overdue for the overdue period. |

| 16 | Force Loan | Highest published Rate |

| 17 | Bank Guarantee Commission | |

| 17.1 | Bid Bond | 1.0% p.a. (0.25% p.q.) or Rs. 1,500/- whichever is higher |

| 17.2 | Performance Bond | 1.20% p.a. (0.30% p.q.) or Rs. 1,500/- whichever is higher |